“There are two things that are certain in life… Death & Taxes.” This is one of many great phrases that Benjamin Franklin has coined. While death and taxes are most certainly prevalent – one can affect the other simultaneously. The effect of the death of a spouse on one’s taxes can add to an already difficult time.

The greatest eroding factor of wealth is arguably taxes. When a spouse passes away, tax erosion heightens.

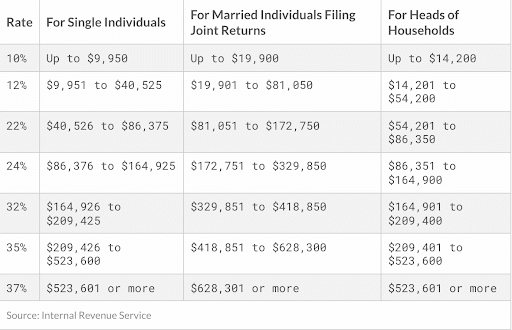

In current tax law, living married couples and widows/widowers have two completely different sets of marginal tax brackets. Why is this? Because the government is hungry for cash.

Let’s look at an example.

John and Jane are the picture-perfect married couple when they reach retirement. John has a pension of $45,000 yr, social security of $32,000 yr, residual income of $15,000 yr, and required minimum distributions of $32,894 from his traditional IRA. Jane was a homemaker for most of her life, but in her working years was able to obtain a pension benefit from an employer of $10,000 yr. She also is able to draw ½ of her husband’s social security benefits.

Their combined adjusted gross income with respect to provisional social security income is $143,694. This is before deductions and tax credits. This puts them in a marginal tax bracket of 22%. After the standard deduction and old age deduction, John and Jane’s tax liability would be $16,333 with an effective tax rate of 10.82%.

Sadly, the next year John passed away. Jane is now a widow. Unfortunately during the mourning of the loss of a spouse, time does not stop and April 15th comes around.

Now, Jane takes an evaluation of her financial position and all that John was able to leave her. In his life, John did a great job securing an income legacy for Jane. He is able to leave her with an IRA of $500,000, 50% survivor benefit on his pension, and 100% of his social security. On top of this, Jane is still receiving her pension and residual income. Her taxable income with respect to provisional income on social security is now $107,594. Yes, her income is smaller than when John was alive. Now let’s analyze the tax due…

Jane is now in a single (widow) marginal tax bracket of 24%. With less income than before!

Her tax due at the end of the year is now $16,563. Jane’s tax is higher with less income.

Let’s look at why this happened. As one could see in the above chart of marginal tax brackets, a single filer’s income limits to marginal tax brackets are much different than married filing jointly. Another key factor of current tax law is the standard deduction for the single taxpayer is ½ of the standard deduction of a married couple. This is an issue for Jane and any widow/widower that gets left in a type of situation like this.

In an ideal world, spouses would pass away together in their sleep due to old age. Sadly, this is not reality and it is imperative that folks plan for the unexpected.

What can one do to avoid a situation like this? John and Jane lacked a sound retirement income and succession plan. John and Jane could have cut Jane’s “widow tax” in half if they would have saved & distributed their money a little differently.

Where folks save their money is crucial when it comes to taxation and succession planning. A few small changes to John and Jane’s financial & savings strategies would have been worth thousands of dollars in tax savings… and less stress for Jane when John passed away.

Let’s not be like John and Jane. Talk to a competent financial professional today. Trust… but verify that the strategies they are suggesting stand the test of time. If your professional is not talking to you about tax mitigation strategies with your finances… get a second opinion.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. It is only intended to provide education about the financial industry. Please consult your certified financial advisor.