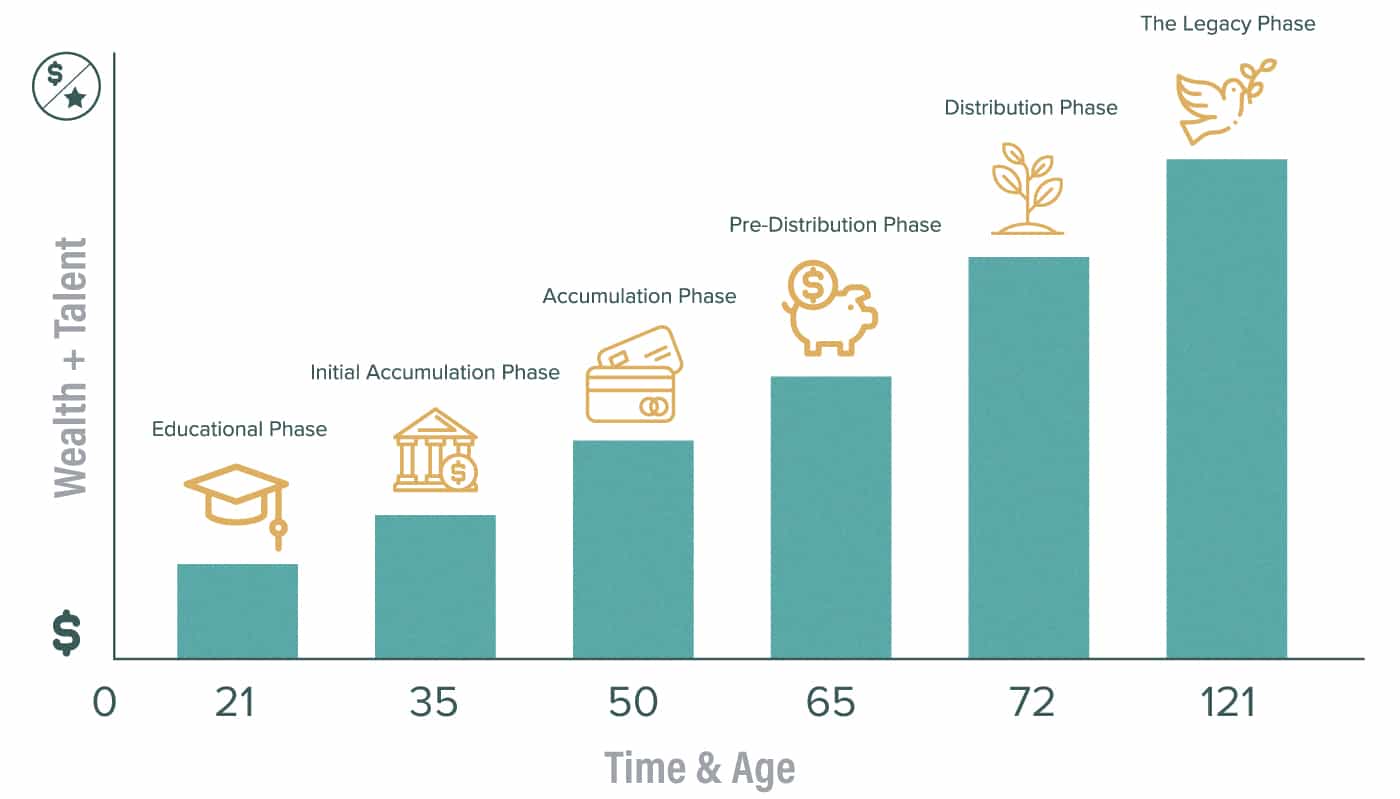

Most financial institutions teach the rule of 100. We subscribe to the idea that economists say you may live a long time… therefore plan as such using the KP121 Rule.

The KP121 Rule™ focuses on the Accumulation, Distribution, & Legacy Phases using the KP Financial Model™ to verify the APPROPRIATE BLEND with instruments of actuarial science & investments over your financial journey.

To understand the appropriate blend of actuarial science and investments, we must explore the age-appropriate, asset appropriate, income appropriate timeline to manage the balance of risk/reward.

0-21 Education Phase

- This is where solid money relations are taught preparing individuals for the Initial Accumulation Phase (IAP)

- As you age the burden of protection and the need to save for the pre-accumulator shifts from the caregiver UNLESS special needs exist

- Very little to no focus is necessary for protecting personal assets at this phase

- Very little to no focus is necessary to protect income in this phase

- Until assets accumulate beyond the max acceptable loss of the provider, there will be little need or want to provide protection over the pre accumulators life

- Maximize tax-free, tax-preferred vehicles & instruments

21-35 Initial Accumulation Phase

- Protection

- This phase is designed around protecting future income producing potential

- The likelihood of a young person in the IAP phase is much more likely than premature death

- This creates the need to protect income earning ability greater than in the later accumulation years

- In this phase, individuals build family and create more of the need to protect the ones they love

- Savings

- The principle of paying yourself first

- Goal of saving 15% of gross earnings

- Tax-free, tax-preferred, tax-deferred in this order IF you believe taxes will be higher in the future

- Diversification of savings should consist of 70-80% at risk, and 20-30% in safe money assets (24 months of cash flow)

- Growth

- This is the ownership component

- Real estate, first-time homebuyer, understanding the use of proper leverage at 75-100%

- Build wealth with credit & leverage potential

- Expansion of liquidity, use, and control of assets

- A strategic balance of risk/reward

- Works with an investment advisor to develop an investment policy

36-72 Pre Distribution Phase

- Protection

- 36 → 55 Protect Income

- 56 → Life Expectancy Protect Assets from long term care events

- Protect Assets from liability

- Protect assets and income from disability, medical, long-term care & risk of longevity

- Protect Assets, Income & Life

- The eroding factors of wealth examples

- Premature death

- Planned obsolescence

- Increased Income Tax

- Inflation

- Long-term Care events

- Technological change

- The eroding factors of wealth examples

- Savings

- Build on to 24-month cash reserve (the 3-5 day money access)

- Continues to save 15+% of income (any excess of the standard of living money)

- Goal to reach 100% tax-free distribution phase

- Maximize the efficient match from the employer or your business

- Avoids consumer debt

- Utilizes efficient arbitrage

- Begin to review the use of leverage for cash flow aka. Rev. mtg, SPIA’s, etc…

- Growth

- 3% – 4% minimum shift to non-correlated assets

- Real Estate Ownership grows

- Continue development of investment policy with investment advisors

- Maximize liquidity, use, and control of all assets (ie. cash value) (tax-preferred growth instruments)

- Shifting to more tax-preferred & tax-deferred volatility controlled instruments

- 3% – 4% minimum shift to non-correlated assets

72-121 The Legacy Phase

- Protection

- The goal of a 1-1 ration between protection of assets & value of assets

- To protect income & assets

- Volatility control instruments

- Pensions

- Social Security, SPIA’s, Fixed Indexed Annuities, and Deferred Annuities

- Have adequate life insurance to cover long-term care events and replace assets needed for those expenses

- Savings

- Starts exercising minimum to maximum distributions from qualified retirement instruments

- Seeks to stabilize or grow cash equivalents to beyond 24 months

- Seeks to maximize the use of distributions in every tax-free asset available

- Distributes necessary standard of living cashflow

- Growth

- Align assets for maximum enjoyment of wealth w/o risk of running short

- Maximize volatility control

- Minimize the risk of loss

- Utilize real estate strategies for max L.U.C

- Develop investment policy w/IA for max distributions for maximum enjoyment

KP121 Rule™ focuses on the Accumulation, Distribution, & Legacy Phases using the KP Financial Model™ to verify the APPROPRIATE BLEND with instruments of actuarial science & investments over your financial journey.