Beliefs drive behaviors, behaviors drive relationships, and relationships drive results.

The results that we get from money behaviors confirm or challenge our beliefs and the cycle continues.

We discover these money beliefs, behaviors, relationships, and ultimately results with each client and would like to take the journey with you.

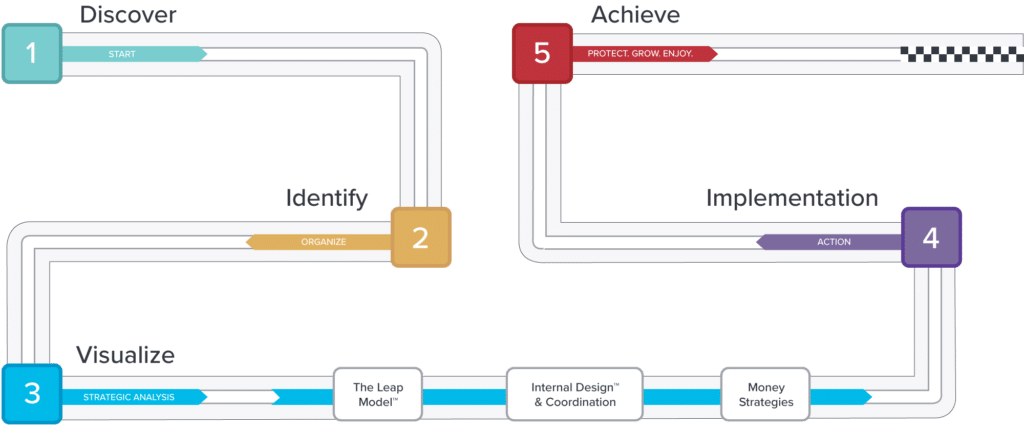

1. Discover

Our first stop on our journey is Discovery. It is here where you as the prospective client are finding out if we are a good fit for you and we are doing the same. Together with you, we look at your current financial situation–everything from your Insurances, savings strategies, debt, real estate and much more. While we gather all the pieces and look at them as whole in the KP Financial Model™, we take into consideration the KP121 Rule™, we are also looking for your beliefs and thus your relationship with your finances.

2. Identify

During our second stop, we look at the map and identify places that may be blind-spots and hazards ahead. We know these as the eroding factors of wealth such as, tax changes, inflation, market fluctuations, lawsuits, technological change, cost of living adjustments, planned obsolescence, and many more.

In our Discovery, we looked at the overview of your finances. Now, through identifying we look at what risks, potential limitations or roadblocks may be ahead on the journey and the effects of KP121 Rule™.

3. Visualize

On this part of the journey, we will stop and look at the roadmap. By this point we will have designed an interactive plan that helps you, the client, get from where you are… to where you want to be. During this stop, we will present a timeline of the client’s net wealth and risk for the rest of your life should it be in your best interest to make changes to the client’s current plan.

Our goal during this step is to test variables that could affect one’s financial plan such as inflation, tax increase, market corrections, etc. We have discovered you are a fit for us and we are a fit for you. We’ve compiled your current financial situation.

We have also identified what is ahead for you on your journey. Here in visualize we look out into the future and visualize where you want to go. We look at the road map and visualize what directions we can take to get you to your destination.

4. Implement

In implementation, you as the client, decide one of three options; implement all of what we recommend, implement some of what we recommend, or implement none of what we recommend. We can not make this decision for you. Should you, the client, decide to implement anything that we have recommended we will begin the onboarding process like everything else, our team has made this a painless process.

5. Achieve

This is where you as a client have maximized your current and future wealth with Sane Solutions, Sound Strategies, and Simple Steps. Take a moment and look at all you have accomplished! Our top priority is helping clients get from where they are financially to where they want to be. We help achieve this by practicing radical transparency with our clients and giving them the information they need to know to make informed decisions about their current and future financial positions.