Our Money Philosophy is to teach our clients great financial habits from the beginning.

To help us verify clients’ financial decisions we use the LEAP financial model. This model takes into account protection, savings, growth, cash flow, income, expenses, and debt to give us what we call a Present Financial Position.

By looking at where you currently are, our team is able to help clients understand how the financial decisions they are making today affect their future wealth. Armed with sane solutions, sound strategies, and simple steps, our clients are empowered and confident in their financial journey. In using this financial model, our clients gain confidence for their financial future.

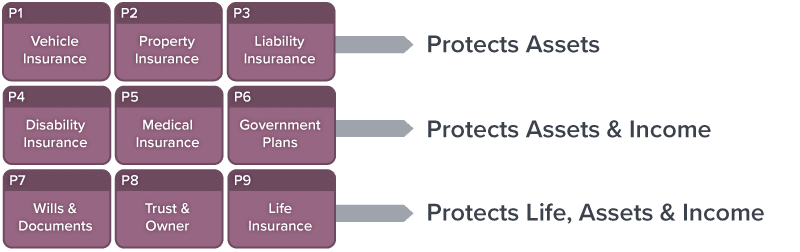

Protection Component

Properly placed protection components mitigate assets, income, and life’s unforeseen events.

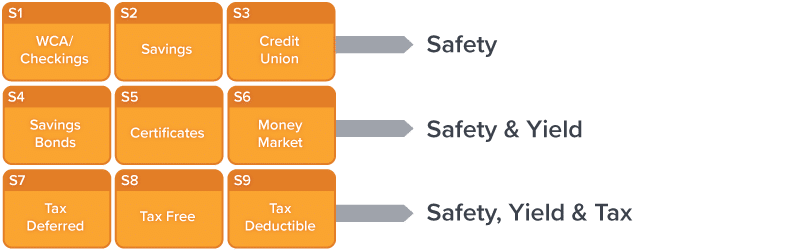

Savings Component

Knowing where and how you are saving can affect future wealth and tax considerations.

Improper placement of savings can have unknown future consequences that greatly affect standard of living.

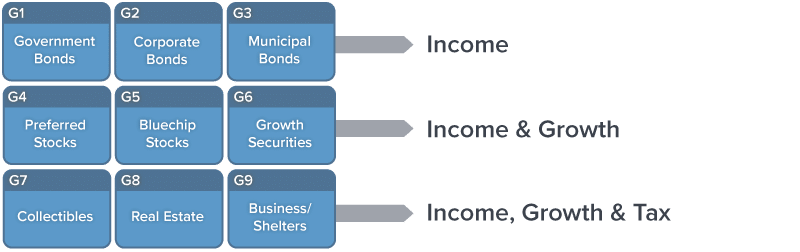

Growth Component

Non qualified savings and investments are crucial to wealth building.

These types of assets can cause hefty YTCG & STCG, so identifying the titling and basis of these types of accounts can mitigate potential risks.